In an NFT project, the mint – the process by which tokens are initially allocated – largely determines who your community is and how they and the broader market view the project going forward. You are who you keep company with – which means you need a mechanism that draws participation from the people you want, and to execute it in a way that is easy, secure, and engaging.

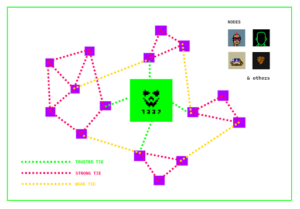

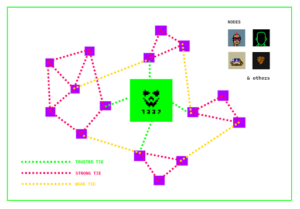

In this piece, we review a new minting strategy recently introduced by 1337 Skulls [ed note: who are hence coauthors of this piece] – something we call a “wave mint,” in which members of different NFT communities are invited to mint in a series of waves, starting with closely overlapping communities and gradually expanding outwards. The wave mint leverages people’s on-chain data and reputation to select for holders who are well matched to a project’s culture and goals – while at the same time driving attention and energy to the project. It also avoids common problems with “free” mints, like gas wars and bots.

We explain how the wave mint mechanism works, its advantages and challenges, and some notes from our own experience running a wave mint in practice. As NFT communities experiment with different minting and engagement strategies, we hope this will be a useful element of the overall toolkit of options artists, builders, and other project creators have.

How a wave mint works

Giving away NFTs for free can be a great way to involve many people in a project – at least in theory. But in practice, free mints make it hard to curate the community because such offerings can be overrun by botnets and/or “tourists” who are just planning to resell the tokens and not stay in the community long-term.

How can a project instead find people who share the project’s values and goals? One answer is to look for those who already have related NFTs in their crypto wallets and invite them in.

In a wave mint, different groups of people are invited to mint in sequence, with each open minting “wave” running from anywhere between a few minutes and a couple of days. As long as the number of people participating in each wave is low relative to total token supply, minting can be free (or, more generally, below the market-clearing price) without leading to gas wars.

The groups invited to mint during the different waves should be chosen with an eye toward recruiting holders who are likely to engage seriously with the new project and support its goals and aspirations. Perhaps the easiest and most straightforward way to do this is to draw upon established communities with shared interests: 1337 Skulls offered minting waves for similarly-situated cc0 projects such as Nouns and Blitmap; an on-chain game, meanwhile, might open waves for holders of projects like DigiDaigaku and Pirate Nation.

Crucially, each wallet should be allowed to mint only once, even if it qualifies for multiple waves. Many NFT communities do overlap, so limiting each wallet to a single mint helps ensure a broad distribution of holders. (Even with such a limit in place, it can still be beneficial to hold NFTs from multiple invited communities because that gives multiple opportunities to mint if, for example, someone misses their first wave of eligibility.)

The communities themselves should be curated thoughtfully to first develop a strong core holder community and then build outwards from there. This strategy relies on the strength of close ties for building a core community and establishing social proof, and then leverages weaker ties to bridge into more distant, but still like-minded networks.

Early waves: “trusted ties” – Early waves should focus on communities with “trusted ties,” where the creators have strong personal connections as well as an established presence and reputation. Working with close and trusted communities early on can help build faith in the new project, and also provides an opportunity to watch for bugs or anomalies in a controlled environment. And this is a logical starting point especially because in a wave mint, people are typically minting from wallets in which they hold other NFTs, potentially even high-value ones; establishing early mints from trusted-tie connections helps provide the social proof needed for people to be comfortable with the minting process.

Next waves: “strong ties” – Once a core community with trusted ties has been established, it becomes possible to target “strong tie” communities, that is, those with significant overlap in holder numbers with the communities recruited in through the earliest waves. This enables word-of-mouth to grow and also helps bring in people who are especially likely to want to be part of the project.

Subsequent waves – Once a project has established a core community and has drawn attention from other related communities, it becomes possible to open up a number of mint windows to larger communities with weaker ties, pulling in people who didn’t necessarily have direct connections but who have become excited about the project over the course of the earlier waves.

The wave mint

We tested out this minting approach in the context of launching 1337 Skulls, an NFT project aiming to build bridges among NFT communities that have opened up their intellectual property for extension and remixing under “Creative Commons Zero” (cc0) licensing. The wave mint was a way to draw in holders who were themselves enthusiastic about cc0, on-chain art, and Internet remix culture, more broadly.

We started with communities that we ourselves were personally close to, and then opened waves for holders of a number of other projects in the cc0 NFT ecosystem. As we progressed through the mint, we gradually introduced waves that targeted larger groups, but were shorter. Toward the end, especially, we aimed for especially brief waves for holders of various NFT projects that had commonalities with those selected in the early waves (e.g., similar aesthetics, launch dates, and community management styles). In this way, we implicitly selected-in members of those weak-tie communities who were especially interested in joining ours.

Evaluating the wave mint strategy

By design, the wave mint approach selects for people who identify with a project’s goals and values up front. Moreover, each wave brings in a group of people from an established community during the same period, which immediately creates a network effect, helping overcome the cold-start problem.

From a go-to-market perspective, this presents a significant opportunity for compound audience growth – “member get member” – with information about each mint wave spreading quickly by word of mouth within and between communities. And from the perspective of community-building, the wave mint approach helps ensure that most token holders will have at least a couple strong ties in the community from the very beginning.

We also found that, at least in our case, the wave minting process itself also drove attention to the project. Drip-feeding the mint over hours and days made it possible for the 1337 Skulls community to look at and appreciate the NFTs as they were revealed (which happened instantaneously upon mint), and made it easier to welcome and onboard new community members in real-time.

From a mechanism design perspective, the wave minting format means that people’s wallets effectively function as a form of “proof of unique personhood.” Many people keep the majority of their NFTs – especially high-value ones – in one or at most a few wallets (although this is not recommended security practice!). Limiting the mint to one NFT per wallet helps reduce double-counting. At the end of the 1337 Skulls mint, for instance, the project had over 50% unique holders (measured as distinct wallets) – much less concentrated supply than in many allow-list mints.

In addition, opening mint windows spontaneously and for short time periods makes the overall mint process harder to game. Doing so also makes it easier to monitor minting in real-time and spot anomalies – for example, if someone distributes snapshotted assets to multiple wallets to gain multiple free mints. The wave format makes it easy for the team to pause the mint in such circumstances, regroup, and figure out a response. And because each individual wave is small relative to total supply, it’s possible to pace supply with demand to avoid the risk of gas wars.

Comparison to ordinary allow-lists

The wave minting strategy has several advantages over the more common strategy of running multiple parallel allow-lists, in which members of specific communities are given an upfront opportunity to register and possibly be included in the mint.

While advance allow-listing mechanisms give people plenty of time to discover the project and register, they often fail to concentrate people’s engagement. Many – ourselves included – have signed up for allow-lists and then forgotten about the associated mints by the time they rolled around. The wave mint strategy tightens the feedback loop from initially learning about the project through existing NFT communities to an action – minting – to subsequently joining and engaging with the community itself.

With upfront allow-lists, there’s also uncertainty about how many people will mint. This often leads teams to over-allocate supply, which can result in massive gas wars. A wave mint, by contrast, allows the project to expand or contract the number of positions available in real-time, adjusting supply to meet demand. You can choose to leave a wave open longer, or open multiple waves to target a particular number of mints from a given community.

At the same time, multi-threaded allow-list mechanisms make it harder to hold users to a minting limit because they give lots of opportunity for people to relocate assets in order to claim multiple allow-list spots. The wave mint mechanism directly addresses this exploit, although the ability to do so relies heavily on having taken snapshots in advance.

And last, more qualitatively, the wave mint can have a “vibe” benefit: Allow-lists managed by application or lottery often result in disappointment. Some people who exert significant effort to research and sign up for these lists are inevitably left out. The wave mint, by contrast, is more likely to result in a positive frame of an open opportunity – at least to the extent that people engage with the process directly. And even if people do miss waves they were eligible for, at least they won’t have exerted any wasted effort.

Challenges: operations and security

From an operations perspective, a wave mint is complex to execute. It runs for an extended period, and requires careful synchronization between front- and back-end teams throughout the process. The front-end and social media teams will be constantly posting on Twitter, engaging on Discord, and fueling fun and attention to the project (as well as speculation about which community wave might open next), while the back-end team will be swapping out wallet lists, opening and closing mint waves, and making sure everything is running smoothly.

On the user side, meanwhile, there are key questions around security. By nature, the mechanism induces people to mint with the wallets they used to hold other digital assets – often ones that may be particularly valuable, such as tokens from major communities. Many people rightly “vault” their high-value NFTs, and bad actors might try to set up false wave mints to gain access to those vault wallets.

With wave mints, it’s even more important for people to inspect each offering carefully, and incumbent on teams to provide clear information and documentation. With waves opening and closing quickly, smart contracts and other key information must be available for examination in advance, and clearly explained and documented. (And while it is always essential for teams to implement maximal security practices around their Discord, social media, and other communications channels, here the need is especially acute to avoid malicious actors hijacking a legitimate wave mint midway through.)

In the longer run, it would be great to see delegation solutions specifically optimized for wave mints, allowing people to delegate access so that they don’t have to mint directly from their vault wallets.

Finally, in terms of incentives, if these wave mints become commonplace, people may start storing their digital assets across many different wallets in hopes of maximizing mint opportunities. This would induce a need for more creative criteria for deciding who should be allowed to participate in each wave.

***

The way that an NFT project forms its initial community is critical to setting its path forward. Getting the tokens into the right people’s hands is essential for establishing the culture from which the community is born. The wave mint was – at least for our project – a powerful solution to that problem. Inviting members of different communities to join in waves made it possible to build a network of holders in a way that was designed for long-term fit and community health, gradually spreading outward from a dedicated, trusted-tie core. While there is certainly more work to be done to explore and experiment with the potential of the wave minting strategy, we hope it becomes a useful element of the toolbox, and would find it 1337 to see others remix and build upon it.

***

Bios and disclosures

8241nD241nd is a game developer, creative producer and pixel artist. A founder and key artist of the Chain Runners NFT project, 8541n has contributed art to other on-chain projects such as Blitmap, OKPC, and PolysArt. He’s interested in building cool stuff and creating new worlds with awesome communities. (Skull #1132)

8241nD241nd is a game developer, creative producer and pixel artist. A founder and key artist of the Chain Runners NFT project, 8541n has contributed art to other on-chain projects such as Blitmap, OKPC, and PolysArt. He’s interested in building cool stuff and creating new worlds with awesome communities. (Skull #1132)

Ch4m is a digital strategist, NFT enthusiast, and pixel aficionado. (Skull #1497)

Ch4m is a digital strategist, NFT enthusiast, and pixel aficionado. (Skull #1497)

d474d4nn3 is a software engineer and tech startup founder. He programs a lot. (Skull #4267)

d474d4nn3 is a software engineer and tech startup founder. He programs a lot. (Skull #4267)

D17h is a former startup founder and active angel investor now leading a GTM function at a large fintech. D17h advises a variety of blockchain and web3 startups on go-to-market and growth strategy, and is an avid jpeg collector. (Skull #1063)

D17h is a former startup founder and active angel investor now leading a GTM function at a large fintech. D17h advises a variety of blockchain and web3 startups on go-to-market and growth strategy, and is an avid jpeg collector. (Skull #1063)

D0d1x (Domenico Distilo) is an Italian film director and screenwriter, as well as the Story-Builder of Citizens of Tajigen and 1337 Skulls. (Skull #2351)

D0d1x (Domenico Distilo) is an Italian film director and screenwriter, as well as the Story-Builder of Citizens of Tajigen and 1337 Skulls. (Skull #2351)

d00d is a spatial turned cultural technologist, making toys that bring us together with Relational. Building HyperXP, the next level of the Rift. (Skull #3945)

d00d is a spatial turned cultural technologist, making toys that bring us together with Relational. Building HyperXP, the next level of the Rift. (Skull #3945)

3p1ku2 is a software developer who has focused on web3 since 2018. He currently works at Tribute Labs. His journey into NFTs began with the Chain Runners community in November, 2021. (Skull #946)

3p1ku2 is a software developer who has focused on web3 since 2018. He currently works at Tribute Labs. His journey into NFTs began with the Chain Runners community in November, 2021. (Skull #946)

f15h8Oy is a full stack developer and founder of a SaaS startup. Lover of pixel art. (Skull #4468)

f15h8Oy is a full stack developer and founder of a SaaS startup. Lover of pixel art. (Skull #4468)

F145h23k7 is a crypto native engaged in various roles across the new digital frontier: collector, investor, founder, DAO member, trader, creator and degen. (Skull #7278)

F145h23k7 is a crypto native engaged in various roles across the new digital frontier: collector, investor, founder, DAO member, trader, creator and degen. (Skull #7278)

h04nh is a software engineer, published author, and founder of several popular open-source projects. He enjoys building and shipping cool stuff in his free time. (Skull #6014)

h04nh is a software engineer, published author, and founder of several popular open-source projects. He enjoys building and shipping cool stuff in his free time. (Skull #6014)

k4m7 is a graphic design graduate from the Royal College of Art. He has worked independently with clients in publishing, music, and advertising for over two decades and is now actively engaged with crypto and web3. (Skull #2118)

k4m7 is a graphic design graduate from the Royal College of Art. He has worked independently with clients in publishing, music, and advertising for over two decades and is now actively engaged with crypto and web3. (Skull #2118)

K0m1n325 is a Professor of Business Administration at Harvard Business School, a Faculty Affiliate of the Harvard Department of Economics, and a Research Partner at a16z crypto. He advises a variety of marketplace businesses, startups, and crypto projects; for further disclosures, see his website. (Skull #1837)

K0m1n325 is a Professor of Business Administration at Harvard Business School, a Faculty Affiliate of the Harvard Department of Economics, and a Research Partner at a16z crypto. He advises a variety of marketplace businesses, startups, and crypto projects; for further disclosures, see his website. (Skull #1837)

M4n1n9 is a pixel lover. He started in crypto during the pandemic and upon discovering this world he fell in love. During the day he works as an Osteopath and between patients takes advantage of any minute to draw pixels and enjoy the web3 world. (Skull #1818)

M4n1n9 is a pixel lover. He started in crypto during the pandemic and upon discovering this world he fell in love. During the day he works as an Osteopath and between patients takes advantage of any minute to draw pixels and enjoy the web3 world. (Skull #1818)

m0nn0 (Rhys Taylor) is Managing Director at VMLY&R, part of WPP plc. In his role he engages clients on branding and customer experience matters, with a focus on the Asia market. (Skull #4438)

m0nn0 (Rhys Taylor) is Managing Director at VMLY&R, part of WPP plc. In his role he engages clients on branding and customer experience matters, with a focus on the Asia market. (Skull #4438)

1980k is a director of design systems and client experience at 23d4c73d by day. Artist, designer, and maker by night. Curious and creative human, always learning. (Skull #3692)

1980k is a director of design systems and client experience at 23d4c73d by day. Artist, designer, and maker by night. Curious and creative human, always learning. (Skull #3692)

nwmd is co-founder and design unicorn at bbuc sports – trying to get people off the couch to discover the outdoors. He believes in the “diy or die” mantra, and catalogs new-type specimens on nm-tds. (Skull #982)

nwmd is co-founder and design unicorn at bbuc sports – trying to get people off the couch to discover the outdoors. He believes in the “diy or die” mantra, and catalogs new-type specimens on nm-tds. (Skull #982)

R08 is a digital strategist and founder who has worked with global tech leaders such as Shopify and Reddit. He is co-founder of Citizens of Tajigen and one of the biggest account holders on Reddit historically. (Skull #2659)

R08 is a digital strategist and founder who has worked with global tech leaders such as Shopify and Reddit. He is co-founder of Citizens of Tajigen and one of the biggest account holders on Reddit historically. (Skull #2659)

541n7573230 is an illustrator/digital artist/designer, and musician/producer/composer. A former UX lead in triple-A games, 573230 is part of the Chain Runners creative team and a collaborator with various projects in the NFT space and elsewhere, including PolysArt and Sup. (Skull #1166)

541n7573230 is an illustrator/digital artist/designer, and musician/producer/composer. A former UX lead in triple-A games, 573230 is part of the Chain Runners creative team and a collaborator with various projects in the NFT space and elsewhere, including PolysArt and Sup. (Skull #1166)

51991 is the 5ku11f47h32. (Skull #2792)

51991 is the 5ku11f47h32. (Skull #2792)

5nj01fu2 is a formally trained code monkey. Decentralization maxi at heart looking to help decentralize the world via on-chain coding. (Skull #4991)

5nj01fu2 is a formally trained code monkey. Decentralization maxi at heart looking to help decentralize the world via on-chain coding. (Skull #4991)

S73v3 is a full stack SaaS developer by day and web3 maximalist by night. He has been an on-chain cc0 fan from his very first mint and stayed a Blitmap fanboy since. (Skull #718)

S73v3 is a full stack SaaS developer by day and web3 maximalist by night. He has been an on-chain cc0 fan from his very first mint and stayed a Blitmap fanboy since. (Skull #718)

V14d7h32u132 is COO at a European legal tech company by day and a degen by night. He is one of the co-founders of Citizens of Tajigen. (Skull #1082)

V14d7h32u132 is COO at a European legal tech company by day and a degen by night. He is one of the co-founders of Citizens of Tajigen. (Skull #1082)

wkm is a full-stack software engineer exploring web3. He has created smart contracts for a number of NFT projects. (Skull #1160)

wkm is a full-stack software engineer exploring web3. He has created smart contracts for a number of NFT projects. (Skull #1160)

***

Acknowledgments: We greatly appreciate the 1337 Skulls community, as well as all the communities that participated in the wave mint, and especially thank the Chain Runners for sparking our collaboration. Special thanks also to our editor, Tim Sullivan!

Disclosures: See full disclosures for a16z crypto and link to investments below; related to this article, the company and all the authors hold NFTs, including some from collections mentioned here. In particular, in addition to the individual disclosures listed above, all of the authors have some degree of involvement in the 1337 Skulls NFT project, and hold 1337 Skulls NFTs as well as NFTs from other cc0 projects. Some are also members of various NFT DAOs.

***

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.